Project for Sustainable Furniture Production

in Lviv, Ukraine

Sustainability in the grain

Briefing Document

January 2020

1.0 INTRODUCTION

This Briefing Document has been prepared in order to assist potential partners with a high level evaluation of the business opportunity (the “Project“), which is the operation of a new production facility for the sustainable manufacturing of wooden furniture in the region of Lviv, Ukraine.

In summary, this operation is planned to have an annual processing capacity of 7,000 cbm round wood for manufacture of sustainable hard wood furniture products (the equivalent of 24,000 standard wooden settee frames, with a trade value of c. EUR 4-5 million). These will be exported predominantly to western European markets, as well as finding an internal market in Ukraine.

Potential partners for the Project, as investor or as customer, may be either:

1) Independent brand owners with a commitment to sustainable sourcing or a desire to move towards sustainable sourcing

2) Furniture sub-contractors who wish to expand their production base and diversify their geographical sourcing or sub-contractors who want to add a sustainable offering to their production, but who understand that a dedicated sustainable facility is preferential to trying to convert current production capacity.

The Project is open to various forms of co-operation and capacity allocation within the facility.

1.1 MARKET

The world market for furniture is currently valued at around USD 331billion and is expected to reach approximately USD 472 billion by 2024, growing at a CAGR of around 5.2% between 2018 and 2024. Europe accounts for around one quarter of the market, with a similar projected CAGR. Of that, a quarter of furniture is made predominantly of wood, with over half having significant wooden componentry.

However, despite growing demand for more sustainable consumer products, there are very few furniture manufacturers in Europe that can not only provide the credentials for using sustainably-sourced raw materials, but also provide the credentials for manufacturing and business processes that are also optimally sustainable.

There are very few certified sustainable furniture manufacturers of furniture, and the closest major buyers get to demonstrating comprehensive sustainability are those, like Ikea, who pledge to source 100% of wood from FSC forests. There is consequently a major first mover advantage to being able to support brands and re-sellers of sustainably marketed wooden products, and not necessarily just in furniture.

1.2 WOOD OF CHOICE — BEECH

Beech wood is a fine-grained wood with even texture that has a light orange to salmon colour, which offers a distinct contemporary appearance. Furniture makers often appreciate its distinct pore pattern. Its light coloured look makes it ideal for a wide range of stains and finishes, though these can be more challenging from a sustainability point of view. Its even texture makes it ideal to polish.

It is also a very strong hardwood and is extremely shock-absorbent. In terms of its workability, it works with machines and hand-tools alike very well. It is easy and clean to plane, rout, sand, carve, and bend, including the ecologically favoured steam bending. It also takes very well to gluing and nailing, notwithstanding the type of adhesive used. Moreover, it is excellent over time as it is resistant to compression and splitting. It is virtually a wood than can do anything other than heavy structural support.

Sometimes considered to be less attractive in furniture than oak, it is often therefore used in making lower end solid wood furniture such as wishbone chairs, home furnishings and interior design projects in general. One of the advantages of using beech wood for furniture is that it is odourless. It is the best choice to avoid a wood smell in the living room or bedroom, and yet want light coloured furniture. It has a high shock resistance. The lower price of beech for use in furniture makes it a preferred choice as secondary wood — that is, wood used to build the areas that are more inconspicuous, such as chair legs, or the back and sides of a drawer. The straight grain also gives legs additional strength. Beech can be aimed at a price point for those with a lower disposable income but sustainably aware. For millennials, this will become more important for higher value items such as furniture over the next few years, where trade-offs are more likely to be made versus the arguably better aesthetics of alternatives, such as oak.

1.3 FOREST STEWARDSHIP COUNCIL

The FSC (Forest Stewardship Council) is a non-governmental non-commercial member organisation, founded in 1993 to protect tropical forests from intensive logging. The FSC Forest Management Standard is widely spread among the world and these standards stipulate the use of silviculture (selected cutting) in the methodology of harvesting in forests. Obtaining an FSC Certificate enables enterprises to sell timber and wood-based products on European and American markets. The area of FSC-certified forest in Ukraine as a whole continues to grow and now comprises 30% of country’s total forest.

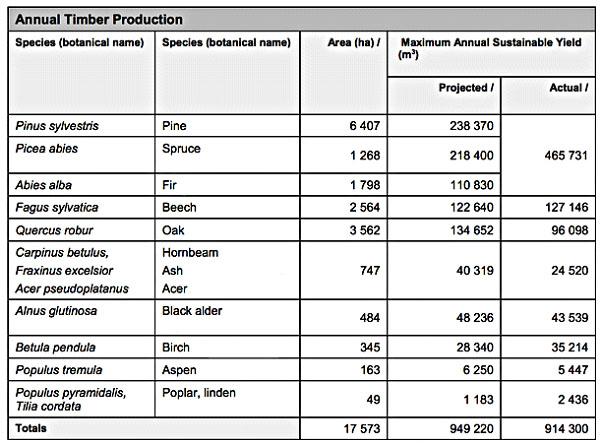

In the Lviv region, the area of the Lviv FSC-certified forest covers 455,000 ha representing over 70% of the total forested area. Of this 254,000 ha is eligible to be harvested sustainably, to a maximum of 17,573 ha annually. According to the FSC certificate itself, of that, beech represents 14% of the cubic metre output:

FSC is similar to the Programme for the Endorsement of Forest Certification (PEFC) used in some other countries.

This Project is configurable to use any wood locally available (listed in the table above) other than beech.

1.4 WHAT IS SUSTAINABLE MANUFACTURING OF FURNITURE ?

‘Sustainability’ is the ability to maintain an activity indefinitely over time. A sustainable activity is therefore one that does not exhaust the resources on which it depends. The World Commission on Environment and Development (WCED) has defined it as “Development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

Consumers today are more sensitive to the protection of the environment. Four out of five European consumers would like to buy more environmentally friendly products, provided that they are properly certified by an independent organisation.

As in many areas, the organisation of standards and certifications is not harmonised globally, and whilst a slow and gradual consolidation is anticipated, it will likely be a number of years before the final picture will emerge. Various options have been considered, however the EU Ecolabel has been identified as the most appropriate and trusted symbol to meet this criteria with wide recognition. The symbol demonstrates to a consumer:

* Use of recycled wood or virgin wood from sustainably managed forests

* Limitation of substances harmful to health and the environment

* Design for higher product durability, easy disassembly and recycling

* Use of recycled packaging

* Use of sustainably certified fillers

* Transparency on use of eco-friendly oils, glues etc.

* User instructions for correct environmental use

This symbol can be attributed on a product by product basis, enabling a staged approach to addressing legacy products, but Ecolabel certification shall be the fundamental basis for all new product development as well as the requirement for any potential B2B customers.

WoodMan, the Initial Investor, is currently in the process of gaining accreditation for the Ukrainian version of the EU Ecolabel, Green Crane, for several of its products. Any legacy product of WoodMan that does not potentially meet the criteria for Ecolabel certification shall not transfer into the new facility and be physically and legally separate from the Project. This shall also be a requirement for any potential partner who wishes to use the facility for their requirements.

However, all elements of related business processes within the Project shall conform to environmentally sustainable standards including:

1) Packaging (which is excluded from Ecolabel certification criteria)

2) Supplies of all paper, paper-related and printed consumable supplies

3) Use of solar power to the maximum potential

4) No use of gas

5) Internal use of wood waste for power/heating requirements

6) Elimination of metals/plastics where sustainable materials can be used

7) Local supply, where possible

WoodMan does not use wood-based panels in any serial production. Where relevant, all backboards or drawer bases are made of solid wood. Particleboards, fibreboards and panels often include contaminants (Substances of Very High Concern — SVHCs) from recycled wood, have emissions of Vinyl Chloride Monomer and have plastic foils attached which contain phthalate plasticisers. Additionally wood-based panels shall not contain additives (eg paints, primers, varnishes and adhesives) which have a Classification, Labelling and Packaging (CLP) hazard, with certain strict limits applied to derogations.

Ecolabels place strict limits on all these elements, and supply of sustainably-certified panels is very limited.

1.5 PRICING & COMPETITION

Whilst studies show there to be a premium to be gained from sustainably-certified products (up to 20%), pricing in the Project has been assumed at the same levels as for non-certified equivalent products.

Whilst there are competitors for the supply of FSC-certified furniture in the areas of outdoor and hospitality

applications, these are driven by the sustainability requirements of public-sector procurement policies, especially in

the United States and the United Kingdom. Of these, there are few suppliers that go beyond the use of FSC

certified wood in terms of sustainability commitment, and none obviously so in domestic furniture supply in Europe.

This is also borne out by the fact that there are only very few suppliers with any Ecolabel domestic furniture.

1.6 COMPARATIVE ADVANTAGE

Whilst producing sustainable furniture is not, in itself, new in Ukraine, there is a combination of factors which provide a commercial advantage to the success of this Project:

1) Economy of scale — Whilst there are a number of producers of fine quality hardwood furniture, the absence of systemised manufacture, processes and procedures hinders their development in terms of the replicability of high quality furniture in mass production. Whereas the low cost of labour previously allowed Ukrainian manufacturers to engage in mass production for the likes of Ikea, increasing labour cost has not been offset by productive gains and reduction of waste that must be achieved to remain profitable, through more optimised process flows, better CNC machinery and reduced labour. This Project aims to achieve this, through a sustainable baseline in terms of required output.

2) The construction of the production facility will be undertaken with the latest equipment and incorporate a maximum of recovered energy from the natural waste in the production process. The Project will also utilise solar panel energy.

3) The key human resources for the project — general management, technical and commercial staff – have already been identified and are engaged in supporting the Project.

The Ukrainian economy has also stablised and strengthened signficantly during recent times. In 2019, Bloomberg has ranked Ukraine’s currency as the world’s strongest performer against the dollar, appreciating by 19%.

1.7 INITIAL INVESTOR

WoodMan, the initial investor, has been successfully manufacturing wooden furniture in the Lviv region since 2012 in the ecologically clean area, near the Yavoriv National Park in Lviv region, Ukraine. The wood used for all catalogue furniture is primarily beech, utilising FSC-certified sources near to the manufacturing facility. Some custom-built furniture may be made from other wood and wood-based panels.

From the very start, the company was focused on producing only eco-safe products. Not by accident, the first products to be manufactured in WoodMan were children’s cots, the most ecologically demanding product. After obtaining a leading position in the domestic children’s furniture market and recognition of the customers, WoodMan launched the production of the upholstered home furniture. WoodMan is a full circle production company, what allows us to be maximum flexible, quickly react to customer trends and to satisfy the demand. WoodMan offers sofas, chairs, tables, cupboards, сhildren’s cots, and many other products from natural beech wood.

The upholstery side of the business operates from a separate facility. Whilst WoodMan will contribute its wooden manufacturing capabilities to the Project, the upholstery side of the business will be kept outside of the Project. WoodMan also owns a sawmill, which is currently not utilised, but may become economic to operate at certain levels of output.

WoodMan has acquired considerable experience in furniture manufacture in Ukraine according to the norms of furniture manufacture. Current production facilities have area of 1,200 sq. metres, with an annual production capacity is 1,000 cubic meters of round wood processing, based on a single shift model working Monday to Friday. The company has a full production cycle that starts in logging round wood and ends with the production of the finished product. Capabilities that have developed include customs clearance of furniture exported to the EU and developing good relationships with local sub-contractors for other componentry, primarily metal fixings and upholstery. Approximately 15% of output is exported to Germany, Denmark, Czech Republic, Switzerland, Poland, Netherlands and the United Kingdom.

1.8 WORK TO DATE

An initial project, partly financed by EBRD, Lviv City Council and the Forestry University in Lviv, created a concept design and youtube promotional video

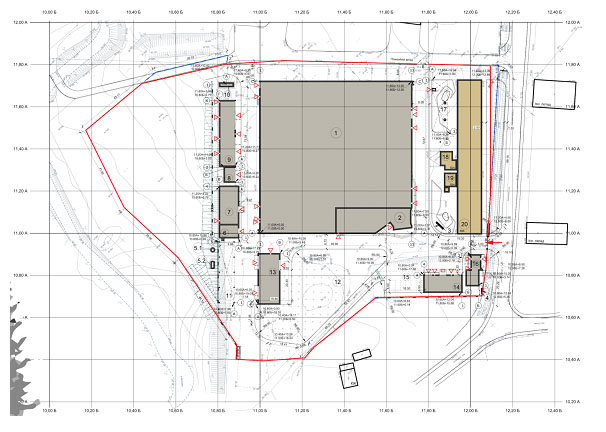

Detailed architectural plans for the new furniture manufacturing facility adjacent to WoodMan’s legacy facility were developed by Kreativ Architecture and Design of Lviv. The facility lies 60 kilometres from the Polish border and direct access to the E40 motorway and 35 kilometeres from Lviv. WoodMan have received all the necessary construction permits for the construction of the facility and these are not time-limited. WoodMan’s additional contribution to the Project comes in the form of:

1) Leased land on which the facility shall be constructed. These land rights shall be transferred into the special purpose vehicle (SPV) established for the realisation of the Project. This land has never had heavy industrial operations upon it, being at one time a collective farm.

2) Project management with respect to the construction of the facility, as well as certain elements within the co-ordinating of the Project to completion.

WoodMan will transfer the necessary construction licences into the SPV prior to financial completion.

A project advisory board (PAB) has been created to promote the project and bring it to fruition. Through its non-Executive Director, Martin Potter, a full Information Memorandum has been prepared, which describes in fuller detail the Project, its deliverables, financial projections and its risks, with the purpose of inviting potential investors to join Woodman, the Initial Investor, in participating in this project. It includes a Business Risks and Sensitivity Analysis, Insurance Analysis, Financing Plan and summary of the Financial Model.

The Information Memorandum is available from Martin Potter (details below). Martin, a UK national, is a Price Waterhouse-trained Chartered Accountant with over 10 years experience developing projects in Ukraine.

1.9 FACILITY and FIXED PLANT

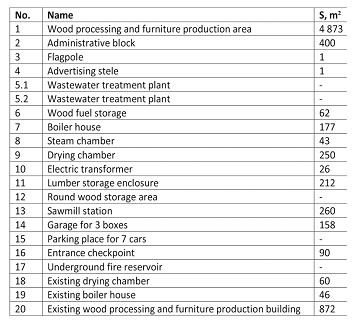

The projected layout of the production plant within a 8,500 sqm plot can be found below:

The key to the marked objects can be found below:

However, the following amendments have so far been made:

1) No provision of a sawmill will be made. Reserve capacity shall be retained by the Initial investor in a separate legacy facility adjacent to the main land plot, however the first policy of the Project shall be to buy all timber already sawn.

2) The current buildings 18, 19 and 20 (marked brown on the plan above) shall be retained by the Initial Investor as a location to retain capability for custom-made products. The resource for this shall be entirely separate from the Project.

3) The current drying chamber will be retained, however additional capacity (9) will only be phased in over time, with the preferred approach being to buy-in additional requirements of kiln dried timber.

Below the second floor administration block (2) is an amenities area of 400 sqm.

The detailed costing of the building work, without several design features which contribute to its operational concept of sustainability totals EUR 2.4m. Relative to the main production hall of 5,273 sqm alone, the cost of EUR 1,780k represents a cost of EUR 338 per square metre.

In general, this construction cost of the main production hall of EUR 1,780k represents reasonable value for money. Using a generic building cost calculator (http://www.warehousematch.com/en/building-cost-calculator/), the cost has been compared to other countries as follows:

Eastern Germany – EUR 2.5m; South East Poland – EUR 1.8m; Lithuania — EUR 1.7m

These costs are significantly less than in western Europe. In order to mitigate the cash flow requirement, a phased approach is being taken to construction.

Fixed plant can be categorised into two distinct elements, that which is contributed by investors, and that which is required to be purchased to meet the future requirements of the Project, its investors and or customers.

The Initial Investor, WoodMan, has reviewed its current plant and equipment and determined that all plant of EU OEM manufacture no older than 5 years shall be contributed to the Project.

1.10 FINANCIAL MODEL AND BASE CASE

A Financial Model has been prepared which includes a base case for production that phases in a ramp-up of activity, using current items in the catalogue of WoodMan are in serial production as surrogates for a future balance of production. They are:

a) Allegro sofa (without soft furnishing)

b) Mexico table

c) Mexico sofa (without soft furnishing)

d) Leonardo cot

This base case can be updated with scenarios of production provided by potential partners.

The Financial Model will be subject to audit from providers of finance as well as future potential equity partners, as required.

1.11 CONTACT INFORMATION

Martin Potter, ACA (WoodMan — Non-Executive Director)

martin@bluebirchua.com

0038-050-432-0490